Ten reasons to separate occupational provisions

Pension fund assets are one of the largest asset positions many employees will have. A pension fund is often also something of a closed book for just as many employers.Besides making “value-preserving” investments in a property, structuring the 2nd pillar in the right way is one of the most efficient methods for tax optimisation.

Separating occupational provisions is also one of the most important measures for planning succession in a company.

Many company owners cannot see beyond minimising salary and maximising on dividends. However, this approach can be problematic from a taxation perspective. In these types of scenarios, we recommend combining models and customising occupational provisions in the way we have mentioned above.

Ten reasons and opportunities with the 2nd pillar

- Separating assets between a basic pension fund and management pension fund provides more flexibility. Splitting the funds allows for customisation and increased asset diversification.

- Making suitable, customised changes to the management pension fund increases the buy-in capacity for the same salary. Buy-ins can be fully deducted from taxable income.

- There is no cross-financing in the management pension fund, so it is certain that the entire pension fund assets will be paid to the heirs in the event of death (no offsetting of present value to fund the spouse’s pension).

- Depending on the model, the investment strategy can be customised down to the individual (in the case of pension plans from an AHV salary of 129,060). If a company defines the management pension fund from the statutory minimum (AHV salary from 86,040), the investment strategy can be defined at company level (uniform strategy).

- With uniform strategies, up to 30% of the pension assets can be accumulated as collective fluctuation reserves depending on the investment profile selected. The company can book these contributions fully under expenses. They are not subject to AHV contributions and therefore not taxable at company level.

- On leaving the foundation (due to age, for example), the securities can be transferred 1:1 into private assets without being sold.

- Splitting between a basic pension fund (mandatory) and a management pension fund (non-mandatory) allows for more efficient, better and tax-optimised withdrawals. It may be advisable to draw a pension from the basic pension fund, although this will depend on each individual case.

- Personal non-mandatory pension assets can be harmonised with private assets, opening up further scope for tax optimisation (real estate, company and securities).

- Financially securing an owner-occupied property is often a top priority. Mortgages may be used in the non-mandatory model (up to 50% of pension assets) in a mortgage pool exclusive to the foundation as a fixed component of the investment strategy. The insured person pays the interest to the foundation and thus to their own retirement savings account. The higher interest rates also reduce taxable income. The mortgage is not subject to any price risks either and therefore partially replaces interest-rate sensitive securities (bonds), which currently provide a minimal yield or even no yield at all.

- The investment profile and allocation down to the specific security can be defined in accordance with the statutory OPO2 investment guidelines. We can consolidate the pension portfolio with other assets, providing full transparency on our integral asset management approach.

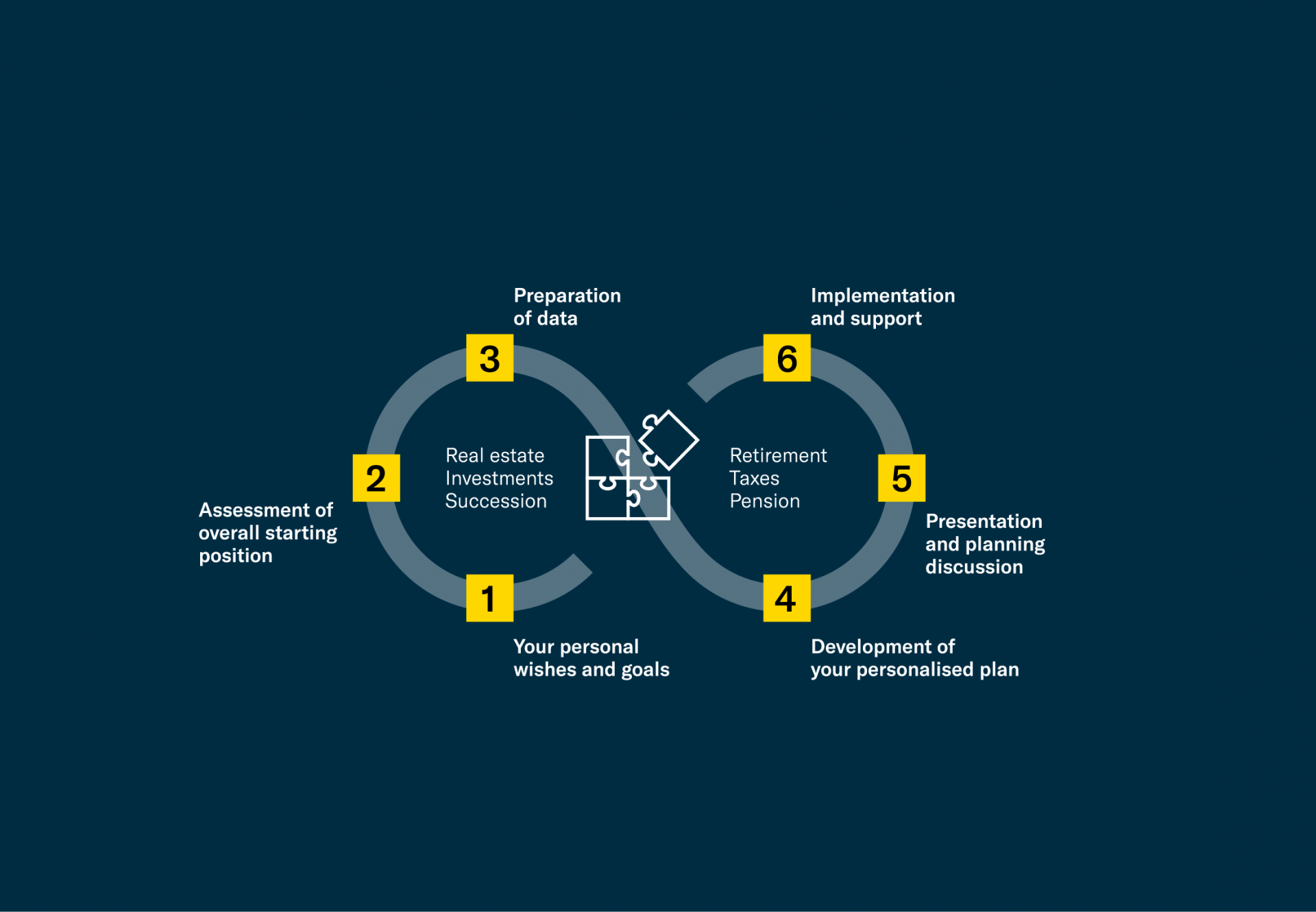

Structuring the 2nd pillar in the right way generates significant added value. This added value is always at the heart of the advice and support provided in such a process. It is important to use the services of an experienced specialist to design and plan a customised, holistic pension solution.

Head of Pension, Partner