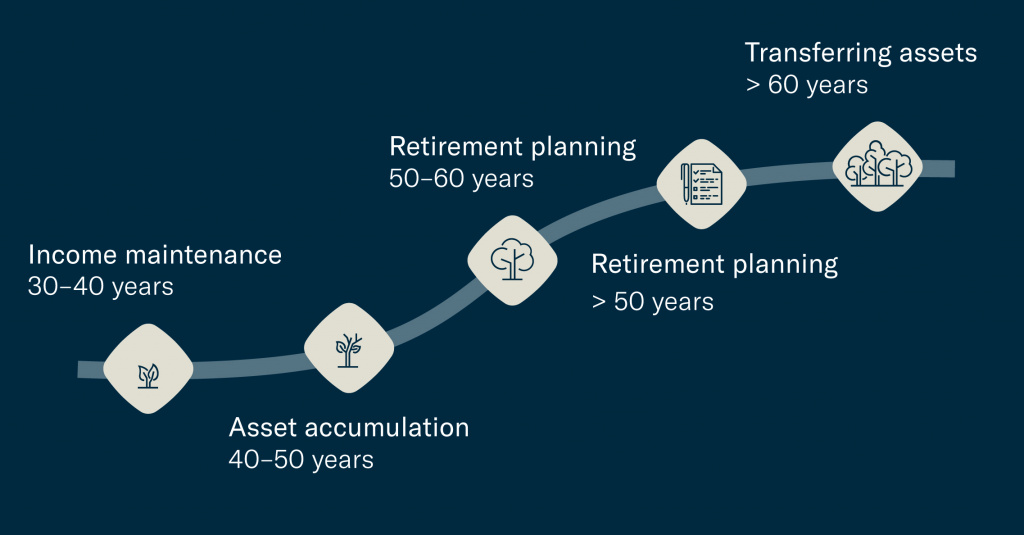

Retirement and pension planning

Retirement planning is and remains one of the core pillars of our life cycle. We would be happy to advise you throughout all stages of your life to help you preserve your wealth over generations.

PLEASE DO NOT HESITATE TO CONTACT US FOR A CONSULTATION

News

„Sell-off“ in the technology sector supports cyclical market segments

The apparent calm on the stock markets is deceptive. Although the global stock market recorded a slight increase in February, the US stock market was once again downgraded relative to Europe and emerging markets. At the same time, the rotation away from highly valued technology stocks toward cyclical value stocks and defensive sectors such as healthcare and consumer staples continued.

After the AI Boom: Broadening the portfolio

About a quarter of global economic growth of 2.3 percent in 2025 was driven by heavy investment in the expansion of AI infrastructure. As a result, AI served as a central pillar of an economy that was robust overall, but below its long-term average growth rate.

AI boom: Is the economy running on only one cylinder?

The year 2025 put the global economy to the test. Political tensions, new alliances and an environment of increasing uncertainty characterised the global situation. Although the economy showed stability overall, it was hardly noticeable in everyday life. It seems as if the economy is running on only one cylinder: everything appears to depend on the AI boom.