After the AI Boom: Broadening the portfolio

About a quarter of global economic growth of 2.3 percent in 2025 was driven by heavy investment in the expansion of AI infrastructure. As a result, AI served as a central pillar of an economy that was robust overall, but below its long-term average growth rate.

- AI investments as a central pillar of growth in 2025

- Sector rotation toward cyclical stocks

- Latin America in focus

In 2026, we expect this trend to become more broadly based, allowing global growth to accelerate slightly. A key factor will be the wider distribution across multiple sectors and regions, reducing reliance on individual structural growth drivers.

A key driver is the global central bank interest rate-cutting cycle. This was initiated in 2024 by the European Central Bank and has since gained broad support worldwide. The prerequisite remains a controlled inflation trajectory, which gives central banks additional monetary policy room. The growth-supporting effect of lower interest rates typically unfolds with a time lag and is expected to become increasingly visible, particularly in the later stages of 2026.

Additional momentum comes from the regions: In the U.S., pro-business policies provide support, while in Europe, extensive fiscal programs stimulate investment in infrastructure and defense. In Asia, the weakness of the U.S. dollar provides a tailwind. This environment is further supported by still favorable, relatively low oil prices, which bolster purchasing power and ease the cost base for many companies.

Broader participation in the stock markets

Since the beginning of the year, a pronounced sector rotation has been observed on global stock markets. While large-cap, AI-sensitive stocks from the technology and communications sectors dominated last year, cyclical sectors such as industrials and materials are currently in the spotlight. At the same time, small and mid-cap companies are gaining momentum, enabling equally weighted indices to outperform their capital-weighted counterparts.

From a market perspective, this development is positive, as it broadens the equity rally and enhances market resilience. Cyclical sectors benefit not only from a brightening economic outlook but also from more attractive valuations compared with defensive growth segments. In addition, early positive earnings revisions provide a fundamental underpinning for the rotation. Against this backdrop, we expect this trend to continue in the coming quarters.

Latin America with new momentum

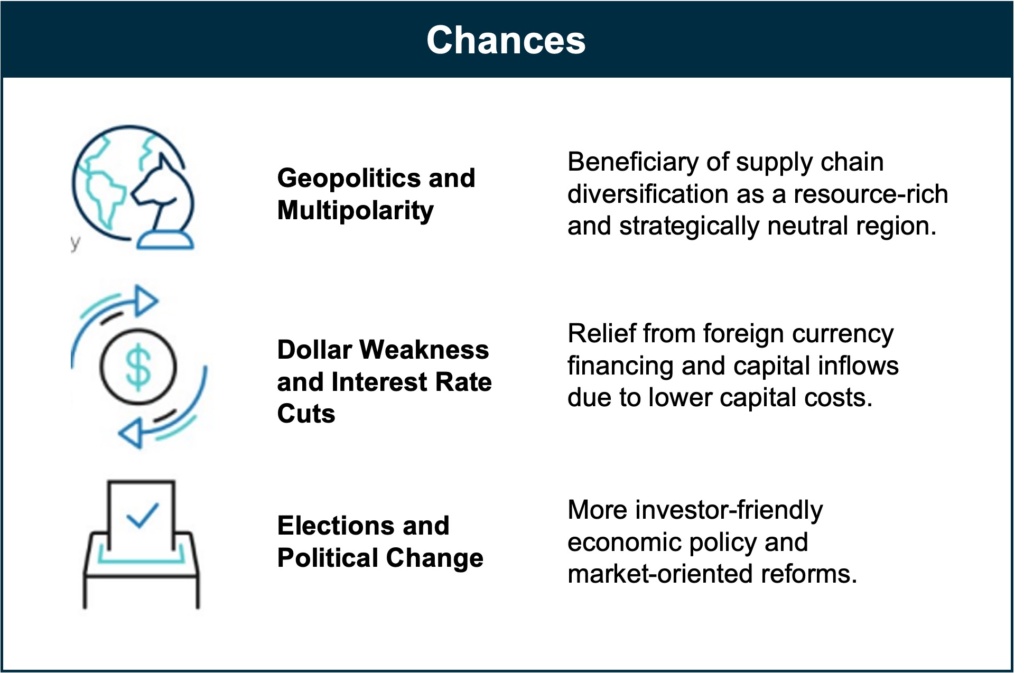

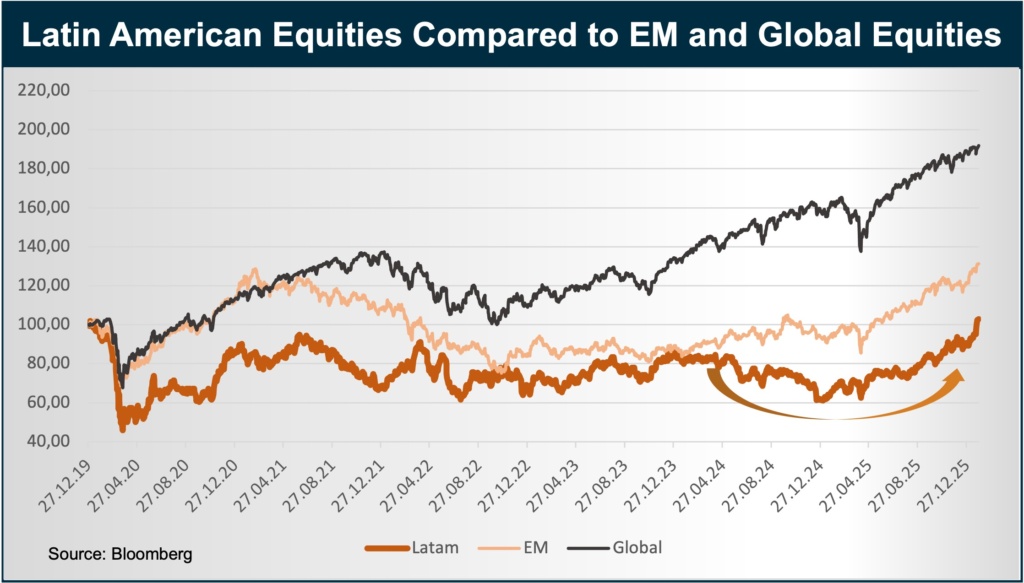

Latin American equities have shown volatile sideways movement over the past two decades and have long taken a back seat to other regions. Recently, however, there have been signs of a structural shift in sentiment. Political reforms and more market-oriented economic policies—in Argentina, Mexico, and Chile, among other countries—are bolstering investor confidence and improving medium-term growth prospects.

Furthermore, Latin America benefits in a geopolitically tense environment from the diversification of global supply chains and its role as a resource-rich, strategically relatively neutral region. An additional boost comes from the weakening of the U.S. dollar, which has traditionally supported emerging markets. At the same time, many countries in the region enjoy high real interest rates, giving central banks additional monetary policy flexibility. Combined with valuations that remain attractive on an international scale, we continue to see significant catch-up potential relative to the global equity index.

Diversification: Complement quality stocks with cyclicals, emerging markets, and commodities

In a landscape still shaped by geopolitical uncertainties, a focused allocation to quality stocks with solid balance sheets and reliable dividend strength remains key—particularly in Switzerland and Europe. Looking ahead to an improving economic environment, it makes sense to strategically complement portfolios with cyclical sectors and selected emerging markets. Alongside Asia, Latin American equities are increasingly coming into focus, where selective implementation and active risk management remain crucial.

Following the parabolic rise in gold and silver, we also recommend shifting part of the gains into selected commodity stocks to benefit from a cyclical pick-up in demand and broaden portfolio diversification.