Booming payment service providers

The global health crises as an accelerator of a structural trend

Megatrends are omnipresent and are considered important drivers of change and innovation. They are evident in all areas and influence our daily lives. From an investor's point of view, it also makes sense to convert them into future-oriented structural growth themes.

Reichmuth & Co has selected 8 megatrends which we consider to be particularly promising. An overview of the 8 Reichmuth Megatrends can be found here. The pandemic has given some of these trends an additional boost. This is true, particularly for digital payment systems.

Credit card payments and e-commerce have been steadily taking market share away from traditional cash transactions for many years now. The Corona crisis has given this structural trend another powerful boost. Although there are regional differences, the global share of digital transactions is still low. Until cash is fully displaced, very attractive growth rates can therefore continue to be expected for the area of digital payments.

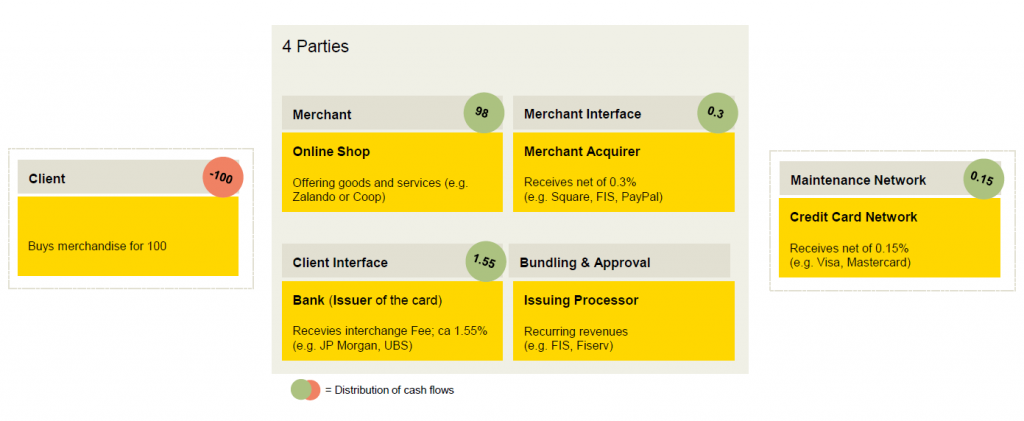

At the heart of digital payment processing is the global credit card network (i.e. Visa and Mastercard). The network connects the customer with the issuer of the customer’s bank card. When the customer carries out a transaction, the one side of the network ensures that different electronic payment methods are accepted (credit or debit card, online wallets such as PayPal, or NFC services such as Twint). The merchant interface (“merchant acquirer”) integrates the merchant directly into the digital payment system. As the most important function, these service providers ensure payment acceptance directly on site, or directly on the online platforms. The other side of the card networks is made of the payment processors (“issuing processors”). They organize the authorization and processing of all cardholder payments for the bank. As shown in the diagram, a portion of the sales value generated is deducted from the merchant as a fee. This fee is then split and distributed through the value chain.

Merchant interface – beneficiary of e-commerce boom

Merchant acquirers are located in an extremely attractive segment of the ecosystem containing several growth drivers. Fundamentally, they are benefiting from customer preferences that are moving away from cash to digital payment options. For more and more companies, a digital sales platform is becoming sine qua non in order to be able to sell products internationally. The merchant pays for this service with of a small fee for each transaction. Companies in this field – e.g. Square, Worldpay (recently acquired by FIS) or PayPal – are directly dependent on the transaction volume. An important differentiating factor is the number of transactions that are ultimately accepted by the provider. Here, the technology is decisive. Fraud should be excluded as far as possible. At the same time though, the approval rate should be as high as possible.

E-commerce has a lot of growth potential, especially in Europe, since market penetration is still relatively low compared to certain Asian countries. Cross-border payments in particular are likely to grow rapidly – driven by online trading. Those companies that can guarantee these international settlements have a strong bargaining position, as they do provide additional revenue to merchants. Economies of scale and an international network are essential for this sector. Leading companies include Adyen or FIS. Other providers focus on smaller merchants and try to grow with these smaller stores (e.g. Square). Providers like Square in particular are already successful in offering additional services beyond the actual payment platform. These cross-selling opportunities often come in the form of enterprise software and have the potential for significant additional revenue, which goes far beyond the potential of pure payment systems. This merchant-focused part shows the highest growth rates within this ecosystem.

«The merchant acquirer benefits from increasing transaction volumes, cross-selling opportunities, and can differentiate itself from the competition through high approval rates.»

Digital banking platforms as growth drivers

Unlike acquirers, issuing processors are less dependent on volume. They receive a monthly fee from the commercial banks, depending on the number of accounts connected and customer cards issued. Therefore, issuing processors often have a relatively stable revenue and cash flow base. In this area, growth is primarily driven by the outsourcing of digital processing by the commercial banks. As competition between the latter and innovative fintech companies intensifies, commercial banks are under increasing pressure to provide digital and user-friendly platforms. At the same time, the importance of bank branches continues to decline.

However, as commercial banks do not want to bear fixed costs, nor the operational risk, the creation of these digital platforms is increasingly outsourced to technology specialists. Companies such as FIS and Fiserv are benefiting directly from this outsourcing and digitization trend among commercial banks. In general, this area is characterized by consolidation, which raises the barriers to entry and reduces the risks of disruption. FIS in particular has established a leading market position in this area. In addition, with the acquisition of Worldpay, FIS has also been able to establish a dominant position in the merchant acquirer segment, and is thus also exposed to the high-growth area of E-commerce.

«Payment processors benefit from the outsourcing potential of banks, and can differentiate themselves through economies of scale, technology and cost leadership.»

Investment opportunities

There are countless companies active in the field of digital payment systems. If you are looking for particularly high growth rates, you are more likely to find them with companies that focus on merchant interfaces. However, selective payment processors and network operators also appear attractive to us. The growth potential is somewhat lower here, but you get the recurring cash flow. For those who do not want to focus on just one company, there are also some ETFs that offer a broad access to this topic.

For specific investment recommendations on digital payment systems, please feel free to contact your account manager or arrange a meeting with us.

We would be happy to discuss specific implementation proposals with you.