Euphoria surrounding artificial intelligence is driving the US market

how long will it last?

Investments by major technology companies in artificial intelligence are reaching new heights. In 2024 alone, the so-called hyperscalers – Amazon, Microsoft, Google and Co. – are expected to have invested around 200 billion US dollars worldwide in data centres, chips and infrastructure.

- High stock market momentum, but still in the early stages in terms of the overall economy

- Proof of productivity impact still pending

- Hyperscalers appear stable

In 2025, this figure is likely to exceed 300 billion. In nominal terms, these are record figures that far exceed the sums invested in digital infrastructure during the fibre optic boom of the late 1990s. However, in relation to the global economy, the scale remains modest: AI investments account for around one per cent of US GDP. This is significantly less than previous technological revolutions such as railways, automobiles, telecommunications or personal computers required during their peak phases.

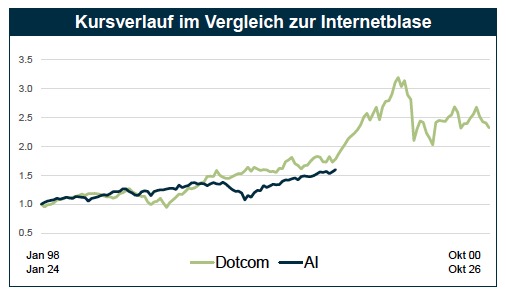

On the stock markets, however, the momentum is reminiscent of the late 1990s: valuations of hyperscalers are rising rapidly, driven by expectations of high growth and productivity gains from AI. The key question is therefore: are we witnessing the dawn of a new era of sustainable productivity or the formation of the next technology bubble? And how long can this cycle last before reality catches up with expectations?

We expect investment to remain high in the coming years. Productivity gains, which are estimated very differently in academic studies at between 20 and 60 per cent, should become clearer in the next 12 to 18 months. As the business models of hyperscalers are significantly more profitable and stable than those of the market leaders in the 1990s, we expect the market in this segment to continue to develop positively. Warning signs to watch out for include greater doubts about the usefulness of artificial intelligence and a rise in interest rates, which would most likely lead to valuation corrections.

Tailwind for Asia

There are signs of cautious détente between Washington and Beijing. The recent meeting between US President Trump and Chinese President Xi Jinping brought about a slight rapprochement. The trade conflict appears to have peaked in the short term. Progress on rare earths, the temporary suspension of additional tariffs and a possible easing of the embargo on high-performance chips signal a new willingness to talk on both sides.

Although many questions remain unanswered, we expect relations to gradually normalise. This is a positive signal for Asian markets. Added to this are attractive valuations and increasing capital flows into the region, not least due to the continuing weakness of the US dollar. US investors are also beginning to rethink their position and once again view China as an investable market.

China itself is focusing on innovation and domestic consumption: following last week’s People’s Congress, which emphasised the importance of stimulating domestic consumption, we expect further stimulus programmes. These measures, combined with further easing in the geopolitical environment, are giving Asia new momentum and opening up attractive prospects for investors in a region that is increasingly growing independently.

Growth through AI and the structural potential of Asian markets

The stock markets are also proving robust at the end of the year. They are being supported by a solid global economy, monetary easing by the major central banks and companies – especially in the US – that are posting convincing quarterly results and optimistic outlooks for 2026.

At the same time, the geopolitical environment remains fragile and characterised by high uncertainty. Against this backdrop, we are focusing our equity portfolio on high-quality stocks with solid balance sheets and reliable dividend strength – preferably from Europe and Switzerland. Depending on individual risk appetite, this basis can be supplemented in a targeted manner: on the one hand, by US growth companies with high innovative strength in the field of artificial intelligence, and on the other hand, by selected Asian stocks with above-average structural growth potential.

This creates a balanced combination of stability, earnings power and future-oriented themes – suitable for a market environment that offers opportunities but requires caution.