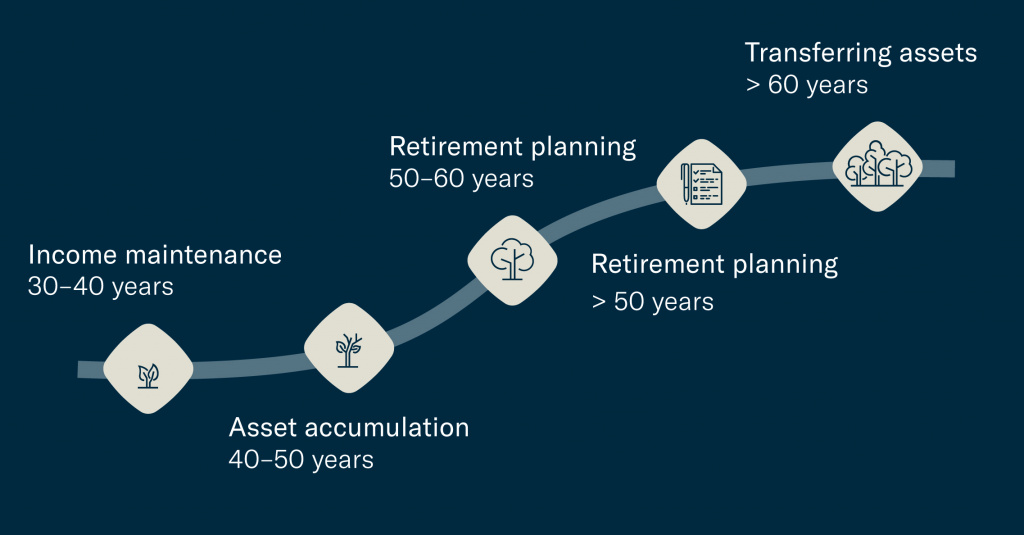

Retirement and pension planning

Retirement planning is and remains one of the core pillars of our life cycle. We would be happy to advise you throughout all stages of your life to help you preserve your wealth over generations.

PLEASE DO NOT HESITATE TO CONTACT US FOR A CONSULTATION

News

Market commentary 3rd quarter 2025

Geopolitical tensions remain high – in the Middle East, Ukraine, and in trade disputes. At the same time, the SNB has lowered interest rates to zero. As a result, there are no longer any secure returns over reasonable maturities. Swiss dividend stocks present themselves as an attractive investment option.

Assets oblige – not only economically, but also in human terms

To what extent did “American philanthropy” shape the origins of the KKL Luzern? Why do many small foundations fail because of bureaucracy – and how does an umbrella foundation help? Why are freedom and individuality crucial for effective engagement?

What “doing good” triggers in our brain

Why do emotions and feelings have much more to do with brain health than solving Sudoku or crossword puzzles? What are the positive effects of “doing good” and why are there no rationally functioning brains?